List Building

Where Do I Even Start with List Building?

The idea of building a list can be overwhelming, so my aim here is to start with the basics and build our way up to the actual steps that are to be taken.

What is a prospect list?

Let's have a quick refresher on what a prospect list consists of.

A prospect list consists of the following:

Contact and/or account basic information (Name, URL, LinkedIn, Title, etc)

Contact email addresses and phone numbers

Contact and account data that can be used to segment and personalize

Most sales leaders go to Apollo or Seamless, enter in some criteria, enrich for contact information, and then export those contacts; completely void of critical information that will help them with timing and relevance.

Account

Company

Contact

Person, human working at a company

.png)

Personalization

A broad term referring to the ability to intentionally reach out to an account or contact at the right time, with messaging specific to them

.png)

TAM

(Total Addressable Market)

The sum of all potential customers

What do I mean by personalization?

By personalization, I’m talking timing + relevance.

Timing refers to the ability to reach out to target accounts and contacts at the right time. This is based on different factors for different companies, but usually involves either cyclic data or researching companies and looking for signals that indicate that they are in the buying window.

Relevance is the ability or degree at which you’re messaging to a prospect aligns with their situation. Again, this is based on market factors as well as researching a company to uncover indicators that they’d be having certain problems.

Let’s imagine that we’re targeting manufacturers: Rather than just reaching out to all manufacturers and hoping that timing is right and there’s a need for our service, we could check to see which ones were opening new facilities in the US or Canada.

This would allow us to (a) reach out a relevant time and (b) personalize our outreach so it’s as relevant to the prospect’s scenario as possible.

Perhaps, in this example, the opening of a new manufacturing facility in US or Canada is something seen in the sales process as a reason for engaging at that time. Sales conversations are a fantastic place to look for signals.

.png)

Personalization can be as simple or complex as you want to make it. For some businesses, just targeting the new manufacturing companies that are opening new facilities in the coming months is sufficient. In most cases though, there are multiple data points to collect so that outreach can be hyper relevant and done at the perfect time.

Where do I get prospects?

So, there are lots of places you can get prospects, an overwhelming amount of places actually. For that reason, I want to keep thing simple.

Four Main Sources:

LinkedIn / Sales Navigator

This is a powerful place to acquire prospects because the information is the most up to date. Databases usually have some time between when something is updated on LinkedIn, and when it’s updated in the database; and there’s also room for error. However, LinkedIn lacks contact information like phone and emails as well as a lot of the data that we need for personalization.

Apollo.io or Another Database

Databases have some lag and data inaccuracy, but depending on the database they come with contact information, like phone numbers and emails; and/or data for personalization, like where and when a company is opening a new facility from our example above.

Scraping Google or A Listing Site

Scraping Google, Yelp, or another listing site is great when you’re targeting small businesses that might not be on LinkedIn. This method might even return accounts, contacts; contact info; and data for personalization all in one place.

.png)

Conference Attendee Page

This is great because these can be highly targeted lists of prospects who come with rich data to use in personalization, and they’re indicating that the timing is right.

The downside is that the lists can be small and often don’t come with contact information.

Don’t worry about how to get prospects from these sources yet, just that these are places where they can come from.

For example:

You could scrape off of LinkedIn Sales Navigator, but you’re going to have to use a database tool to find their email and phone information.

Database

You could scrape an attendee list and get company names, but you’re going to need to use LinkedIn to find contacts at those companies, and then you’ll need a database to find email and phone information.

Scrape Attendee List

Database

You could use one database for contact information, but still need to use another database to find out whether or not a company is using certain technology.

Database A

Database B

In all of these cases it takes more than one of these different sources in order to get all three components of a prospect list.

Filling in The Gaps

So remember, in this context a prospect list isn’t a list of names and companies. It’s a list of names and companies, with contact information, as well as information that can be used to better time and position our outreach.

So while in some rare cases you’ll find all the data you need in one place (accounts and contacts based on criteria, contact information, and data for personalization), most of the time you’re going to need to find a way to string different things together in order to get all three components.

How To String Them All Together

Without getting into the specifics (that’s for another time), the simple answer, if you’re doing things manually, is through a lot of CSV imports and exports. You can use scraping tools to produce CSVs of accounts or contacts from Sales Navigator; most databases allow you to export CSVs; and most scraping tools output in CSV as well.

This means you can build a list in LinkedIn, use a scraping tool to export the contacts to a CSV, bring that CSV into a database like Apollo, find emails, and then export a CSV to upload to your CRM.

The problem is two fold:

Apollo, ZoomInfo, and other databases don’t always have the means of filtering for what you’re looking for. For example, if you’re targeting b2b there’s no filter for that. If you’re targeting manufacturers, there’s no category for that. There are keywords and things you can use to get close, but you will end up including companies that are irrelevant or even competitors. So these lists often need to be cleaned.

These databases only contain basic information on accounts and contacts, and in almost all cases are not sufficient for personalization.

How to Build A List

In this page I want to give you the actionable steps you can take to build a list. If you haven’t already, read through the Where Do I Even Start page.

Define your ideal customer accounts based on basic firmographic data

Answer questions like:

How many employees does your ideal customer have?

How much is your ideal customer doing in annual revenue?

What countries or states or cities are they located in?

What industries are they in?

What types of companies are they (b2b/b2c, SaaS/service, early stage, funded, etc)?

When making these definitions think of things both in terms of the sweet spot and also a range you will tolerate.

For example: Sweet spot is 20 employees, but it’s possible we work with any company 3 - 40 employees.

Define your ideal customer accounts based on their situation and pain points

Just as importantly as firmographic data, include data from conversations where you've talked to customers about their pain points before they met you, their ways of solving the problem then, why they wanted to hire you, who else were they considering, what their expectations were, etc.

Ask yourself, if I was talking to a company I just defined above, what would I love to hear them say in the discovery call because it would mean they’re in the perfect situation for us to do outreach.

Range is Important

If the company you’re defining is so specific there are 40 companies on the planet that match the criteria, that’s going to make outreach limited. If your targeting is broad though that you have tens of thousands of people that will be engaged in the exact same way, it’s likely you can benefit from segmenting that.

The key is to create processes where you can grade or score your entire TAM, or large parts of your TAM, where you look at several data points and then use that to segment accounts and/or contacts into tier A, B, and C. Then each tier can be treated differently based on if they’re getting reached out to on one channel, omni channel, etc; but all tiers can receive a degree of personalized messaging based on the datapoints collected.

.png)

This way you can see those perfect companies, where only 40 in the entire TAM exist, because they meet all the criteria, but you’ll also have companies that meeting 9 out of 10 of the criteria, and 8 or even 5 out of 10 of the criteria; and you can focus on the different groups differently. Then you’ll have thousands or tens of thousands of accounts you can reach out to with relevant messaging.

Determine what contacts you want to reach out to at these target accounts

If this changes at all between different segments of your ideal customer accounts then make note of this.

Decide on how you would build a list of these accounts and contacts, yourself, manually

Write out a step by step process for how you would go about producing a list of these companies yourself.

Where would you start for the accounts and/or contacts - LinkedIn, Apollo, Google?

Does where you start allow you to filter out accounts/contacts that don’t fit your firmographic data?

If not, how are you going to do that?

Does where you start allow you to obtain the personalization data?

If not, are there databases that you can pull it from?

If not, can you research the data yourself on the prospect account’s website?

Where are you going to go for the contacts once you found the accounts and all the data?

Where are you going to go for the contacts’ contact information?

It’s good to execute on these steps several times to make sure they’re repeatable.

Automate the list building and research

Once you have validated that your procedure works to bring you the accounts, contacts, contact information, and personalization data you need for your campaign, you can automate the list building process.

Clay is the best tool for this in most cases. If you don’t know where to start, check out this page:

Defining The ICPs Based on Firmographic Data

Accounts

Manufacturing companies

Following Industries:

-

Automotive

-

Medical Device

-

Chemical

-

Pharmaceutical

Doing over $1b a year in revenue, but would except $500m+

Facilities in the United States

Adding Behavioral Data

From our experience with past customers and the data we have in our CRM we know that when a manufacturing company is building a new facility, it’s the perfect time to deploy our software. We also know if they are doing a merger or acquisition that we almost always hear a ‘bad timing’ objection.

Determine What Contacts we Want to Reach Out To

Contacts

Director/VPs of

-

Quality

-

Safety

-

Operations

-

Manufacturing

-

Continuous Improvement

-

Center of Excellence

Manual Research & List Building

Through some trial and error and some experimentation we find a process that allows us to go from discovering an account, researching the account, and finding contacts and contact information.

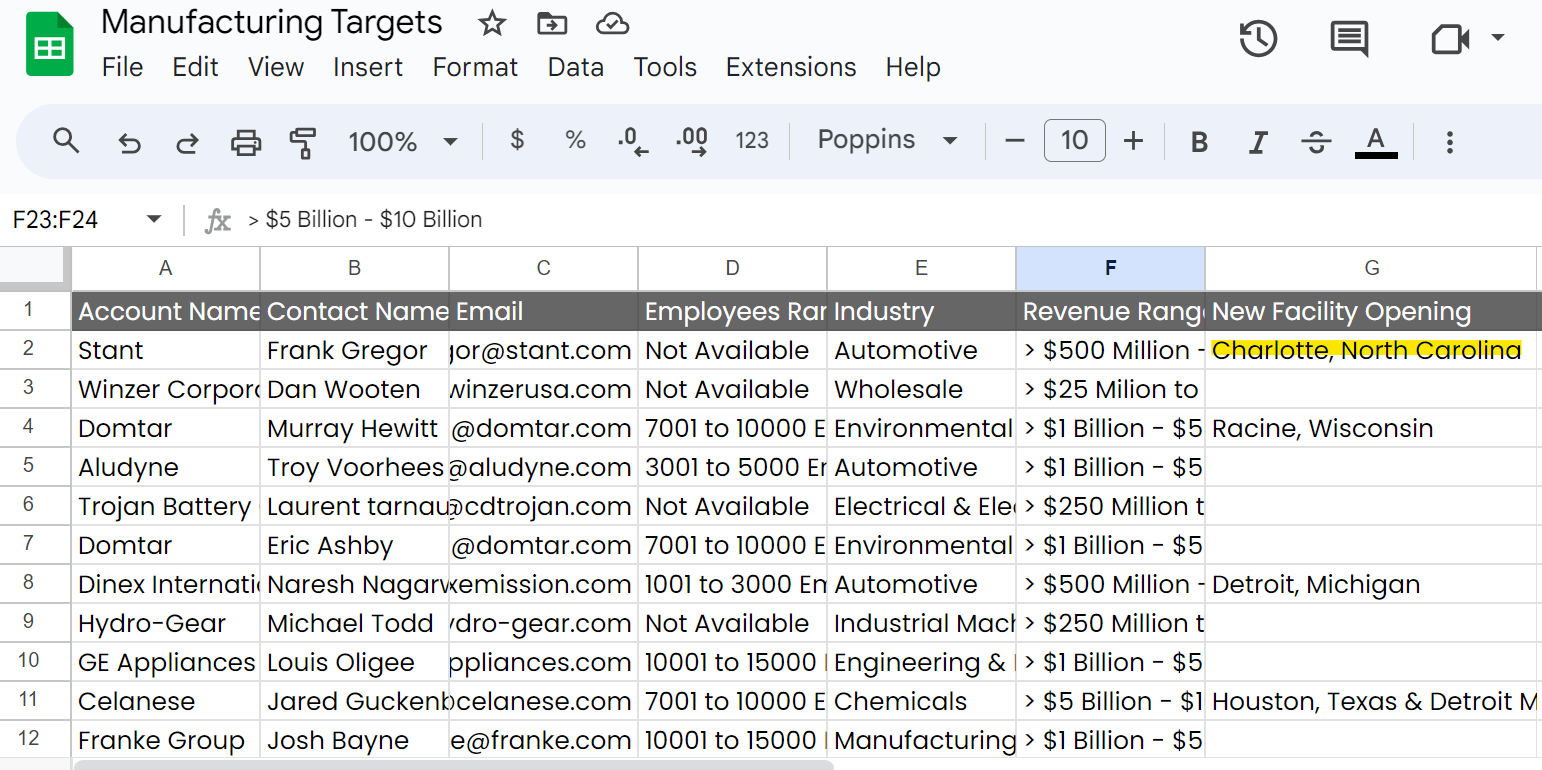

1. Go to Apollo and search for companies that meet the revenue, geographical, and industry criteria; set keywords to “Manufacturing”, “Manufacturer”, “Manufacture”; remove staffing and recruiting, IT, accounting, etc companies

2. Export those companies into a spreadsheet

3. One by one research each company:

-

Go to the companies website and make sure that the company is actually a manufacturing company since the list Apollo gives you won’t be 100% on target

-

Google “[company name] new facilities opening in US”

-

Check to see if there are any companies opening

-

If there are, I would write down the state and other basic information regarding the new facility in the spreadsheet

-

If there aren’t, I’d leave the new facility cell blank for that row

-

Then I’d google “[company name] merger” and “[company name] acquisition” and check to see if there were any M&A related events recently or coming up

-

If there are I’d write it down in the sheet

-

If not I’d leave it blank

4. For any companies that were manufacturing companies and didn’t have M&A activity, I would then go back to Apollo and search for contacts at those companies

5. I would enrich with mobile and email information in Apollo and then export

6. I would bring the contacts into a different spreadsheet, then pull in the new facility information that I had in my account research spreadsheet

7. Then for all the contacts that were at accounts that had new facilities opening up, I would mark them as Tier A so I can put them in a multi-channel campaign

8. For contacts at companies that didn’t have new facilities opening any time soon, I mark them as Tier B and reach out on a single channel

Automate the List Building

Then, using Clay, we can setup some new tables, and configure them to do these steps for you automatically. We can experiment quicker with different data sources like swapping out LinkedIn for Apollo as account and contact sources.

Instead of it taking 3 - 5 minutes to research an account and check for M&A or new facility activity, it takes less than a second.

Let’s See A Real Example!

Ready to see this in action? Let’s see what this looks like if we were a software company selling to various departments inside of big manufacturing companies.

There’s An Easier Way

The answer is Clay has been taking over the sales community over the last year or so. It’s a powerful tool that combines different databases, google scrapers, and more to allow you to build super detailed lists, all in one place.

Clay saves you from needing a dozen or more subscriptions by connecting to the different data providers and allowing you to access them through Clay credits. Clay then gives you spreadsheet like interface where you can automate and create lists using these different data providers and tools. It’s what our agency uses for a majority of our list building work.

For more information on how to Use Clay check out the Learning Clay page.

There are other tools that do this as well; tools like n8n or Make. If you’re just starting out with list building though Clay is by far the best tool to use.